Brian’s Blog

August 2017

Low oil price here to stay

Sadly our predictions for under $60.00 barrel oil for 2017 seems to be right on and perhaps a little optimistic. Never to worry, fracking and other new technologies has pushed the costs of recovering oil to new lows as well but our land locked position here in Canada is a problem and needs a quick remedy.

Even though commodity prices are tanking, or are still in the tank, the CAD seems to be rallying. As an old friend from my childhood would say “Hmmmmm, Expect that to change, I would”.

The Saud’s and the Russians are heading faster and faster down the path of civil discontent as oil prices are nowhere near a level to replenish there cash reserves and so pain is going to increase for those in charge.

It is interesting and worth a few moments to look at why we are in the oil slump that we are.

Drilling for shale oil costs less per project than conventional plays of years gone by. There are two general types of costs: capital costs and operating costs. Capital costs are the investment required to drill and complete the well and build the facilities onsite to manage it. Operating costs are the ongoing costs after the well has been drilled. These are measured either in dollar per thousand cubic feet or in dollar per barrel.

The total well cost – the entire amount of investment required to set up a new well, including land, permits, drilling and completion – varies by location but runs consistently in the low millions of dollars. A report by the EIA estimated that the average completion cost per well is around $5 million to $9 million, depending on the location of the deposits. Some companies, however, are able to drill and complete wells much more cheaply.

According to the EIA, drilling accounts for 30-40 percent of all capital costs. Completion costs, which include the actual fracking process, account for 55-70 percent. Facilities costs, which include erecting onsite buildings as well as road construction to transport oil away from the site, account for 7-8 percent of well costs.

The same EIA report analyzed well completion costs across a number of companies and locations and determined that average costs, in terms of dollar per barrel of oil equivalent – an approximation of energy released by burning one barrel of oil – declined 7-22 percent from 2014 to 2015 and 25-30 percent from 2012 to 2015.

Importantly, some wells are drilled but not completed when funds dry up or when oil prices dictate that the well is no longer economically viable for the time being. In this scenario, the oil driller has effectively used the low permeability of the sedimentary layer to store oil until it’s ready to frack the deposits.

Once the oil starts to flow, operating costs tend to vary. Gathering, processing and transporting can range from $2.25 to $5 per barrel for oil or higher, depending on how far and the mode it needs to be transported by. Water disposal can range from $1 to $8 per barrel. Other general and administrative expenses range from $1 to $4 per barrel.

New drilling techniques can expedite the completion process and thus drive costs down further. Several years ago, a new well might have taken 3-4 weeks to drill. Now it can take as few as 7-10 days. Not only does this cut down on the overall costs of producing a barrel of oil, it also gives producers flexibility to respond to higher prices and to expand their operations. In fact, now that so many shale plays are known to produce, exploration is less risky, so companies are more willing to operate there.

Since capital and operating costs are so varied, there is no single break-even price for shale oil. But if we average wells by location, we can get a sense of which prices generate profit and which do not.

Russia and Saudi Arabia can still produce oil cheaper than the US can, in the $10 to 15 dollar range. Their problem is that the Russians and Saudi’s are so dependent on oil to finance there economies that they literally need $100 oil to maintain the status quo.

US Recession

The US “IS” going to have a recession. It’s just anyone’s guess when that happens. Statistically it is due anytime. The US Federal Reserve is gently upping interest rates to have some dry powder available for when it does happen. It is however, the rest of the world that will suffer the most, as the US is self-sufficient in energy and is not nearly as dependant on others to drive its economy. It derives most of its GDP from its own consumption unlike many countries such as Germany and China.

ISIS

The Islamic State is looking more and more like it will fail in its bid to create a Caliphate in Syria. News of cholera and polio outbreaks are seen as a loss of control in their abilities to provide even basic services. It will now be of interest to see how ISIS regroups and where they pop up. Although before that there is still a bit of work to do routing them out of there strongholds. Now Israel, the US and Turkey will have to decide how they will deal with Assad and his band of terrorists. None of them wants a strong Syrian and Iranian alliance.

Protectionism

So there you have it, more of the same coming up. Growth is slow to non-existent and it is only growth that can increase the use of commodities. So the oil glut will remain until such time as production falls due to lack of revenues and any rise in revenues will result in a rise in production, a circle jerk if you will. The other way out is we somehow initiate growth, but the world is due to shrink in population in the near future so growth may be difficult. Our opinion is that even if we do see growth it may lack the longevity of past booms and will likely be spurred by India and North Africa and a few others. In any event we are a few years away from a demographic trend that will lead to any kind of recovery and nothing indicates that much else can change that. What will probably effect economies as much as anything in this stagnate climate is geopolitical issues arising from civil unrest and protectionism probably caused, at least in part, by the economic slowdown.

At Home

At home here, we are sitting on the boondoggle that is the North West Redwater Refinery that has blossomed from a 4 billion to an 8 or 9 billion dollar project. If this was a viable project in the first place industry would have built it, another reason why government should keep its nose out of business. The only profitable refineries are those that are built to serve the markets that surround them or those that are situated in a place that makes shipping easy like the gulf coast. Albertans will be paying for this for decades.

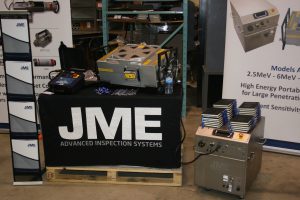

IR is beefing up its rental lines. Currently we are offering Sentinel 880, SCARPro Selenium 75 and 330 Cobalt 60 devices, Open Vision, Sonatest flaw detectors, Comet 300 Kev spot tubes, Vidar digitizers and we lease Armorlite RT labs. IR is now so much more than just a one stop shop for NDT products and services, and keep your eyes and ears open for other products and services soon to arrive like calibration of light meters, and x-ray tube repairs.